在此处更改您的语言和 LGT 位置。

私人客戶的數碼平台

登錄 LGT SmartBanking

金融中介機構的數碼平台

登錄 LGT SmartBanking Pro

解答常見問題 (FAQ)

LGT SmartBanking 幫助

解答常見問題 (FAQ)

LGT SmartBanking Pro 幫助

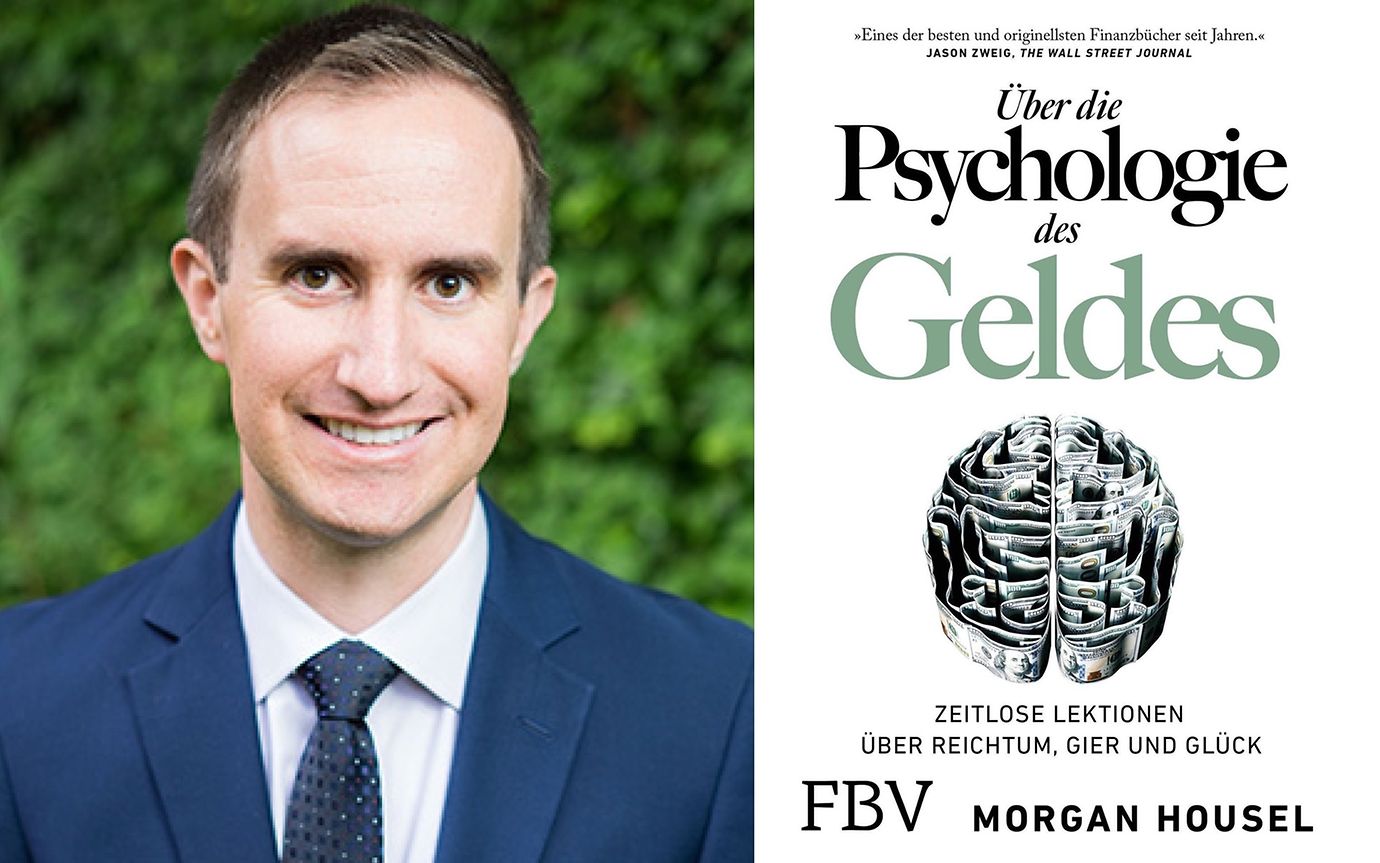

Are your investment decisions based on mathematics - or social pressures, psychology, world-view and pride? Morgan Housel's new book gives inspiring answers.

Anyone picking up Morgan Housel’s new book in search of practical investing advice may come away disappointed. That’s not what the American writer and venture capitalist set out to offer in The Psychology of Money: Timeless lessons on wealth, greed, and happiness. But he offers so much more - a compelling, companionable treatise on what really lies behind financial success.

Housel is a naturally gifted storyteller, and expertly threads his book with dozens of stories and anecdotes, each of which can be read independently. All the stories jump off the page and reveal something about the way behaviour and emotion guide investors and titans of industry far more powerfully than expertise or cold rationale.

“A genius who loses control of their emotions can be a financial disaster,” Housel writes. “The opposite is also true. Ordinary folks with no financial education can be wealthy if they have the handful of behavioral skills that have nothing to do with formal measures of intelligence.”

Housel began writing about finance in 2008, as the financial crisis swept the world. As he explains, examining the cause of the crisis was not like finding the weakness in a collapsed bridge: it was about psychology and history. A report he wrote in 2018, in which he listed the 20 biggest flaws and biases behind bad financial behaviour, became the basis for his new book.

Each chapter has a theme. Housel begins by explaining why no one is crazy, even if people do crazy things with money; we are all guided by the values, politics and economics of the places in which we grew up. We don’t just consult spreadsheets when making financial decisions, but a scramble of societal and social pressures made up of world-views, personal history and pride.

This leads into a discussion about the slippery nature of luck and risk. “The line between ‘inspiringly bold’ and ‘foolishly reckless’ can be millimeter thick and only visible with hindsight,” Housel writes, after examining the coin-toss moments in the rise of business giants such as Bill Gates, who was lucky enough to go to one of the only American high schools that had a computer in 1968.

But what drives wealthy people more than anything to make crazy decisions, Housel says, regardless of their background and proximity to good luck, is an attitude that tells them: a lot is never enough.

Here, we learn about Rajat Gupta, an orphaned Indian with nothing who went on to become CEO of McKinsey and grow a personal fortune of more than 100 million USD. Yet, in his pursuit for yet more money, more prestige - more distance from his origins in poverty - Gupta risked it all and went to jail for insider trading.

Housel doesn’t strip his book of all advice. There are bite-size chunks of it throughout, including in the “never enough” chapter. Keep an eye on what you’re striving for, he counsels: “It gets dangerous when the taste of having more increases ambition faster than satisfaction.”

If some of Housel’s wisdom feels a little obvious, I think that’s intentional. By stripping away much of the mathematics and mystery that can cloud our view of money and the pursuit of more of it, he delivers compelling yet basic lessons that can apply to our decisions and behaviour in so many areas of life.

As any beginner investor is told at their first financial adviser meeting: “It’s not timing the market, it’s time in the market.” Housel uses the case of Warren Buffett to demonstrate the rewards that come with patience and compounding value. As he points out, Buffett, now 90, is worth 84.5 billion US dollars, 84.2 billion US dollars of which he accumulated after his fiftieth birthday.

The key to Buffett's success is not talent (although of course he has it) but time; he started in his teens and has continued long into his dotage. “There are books on economic cycles, trading strategies, and sector bets,” Housel writes, in a correction to the get-rich-quick instinct of less assiduous investors. “But the most powerful and important book should be called Shut Up And Wait. It’s just one page with a long-term chart of economic growth.”

Housel is concise himself, if not quite that concise; his book runs to fewer than 250 pages. But as an investment it offers a good return - it is an insightful, lively, big-picture rumination on money and emotion.

It ends with an analysis of the psychology of Housel’s own finances. After the examples of the Buffets and Zuckerbergs of this world, the writer’s own money memoir is refreshingly quotidian - and perhaps more inspiring for it. His goal has always been financial independence rather than riches. And a satisfaction with modestly growing wealth - and a nice but simple enough life - has been good for saving.

Yet even Housel goes against rational advice and financial orthodoxy, keeping, for example, a big chunk of his savings in cash, which he sees as “the oxygen of independence”. He saves not for a flashy car or bigger house - but for the unexpected expense any family will face at some point. Anything to avoid selling stock, and interrupting that compounding wealth...

Above all, Housel writes, he manages his finances with the nights in mind. As he says in a list of universal recommendations towards the end of his book, “Manage your money in a way that helps you sleep at night… Some people won’t sleep well unless they’re earning the highest returns; others will only get a good rest if they’re conservatively invested. To each their own.” Having this book on your bedside table may also help.

Morgan Housel was a speaker at the last Alumni Event of the LGT Next Generation Academy (NGA). The NGA offers young entrepreneurs and investors the opportunity to consolidate their knowledge of finance and asset management. It is also a platform for international exchange and presents inspiring lectures and workshops on the topics of entrepreneurship and innovation.

LGT's research publications on international financial markets, sectors and companies help you to make well-founded investment decisions. You can find more information here.