This week, we take a step back to look at the various stages of interest rate hiking cycles. The first stage occurs when central banks communicate their desire to begin raising interest rates. The speed and extent of the rate hiking cycle makes up the second stage, followed by stage three, where rates ultimately end up.

Now, after its most aggressive rate hiking cycle in decades, it appears the Federal Reserve (Fed) has reached peak rates in the US, and as such, will undergo the opposite – a rate cutting cycle. The stages here are similar – first the Fed communicates its desire to cut rates, indicating the next move will be lower. Then there is a period of waiting, with speculation mounting over when the Fed will make the first cut, followed by speed of the cuts and where interest rates wind up.

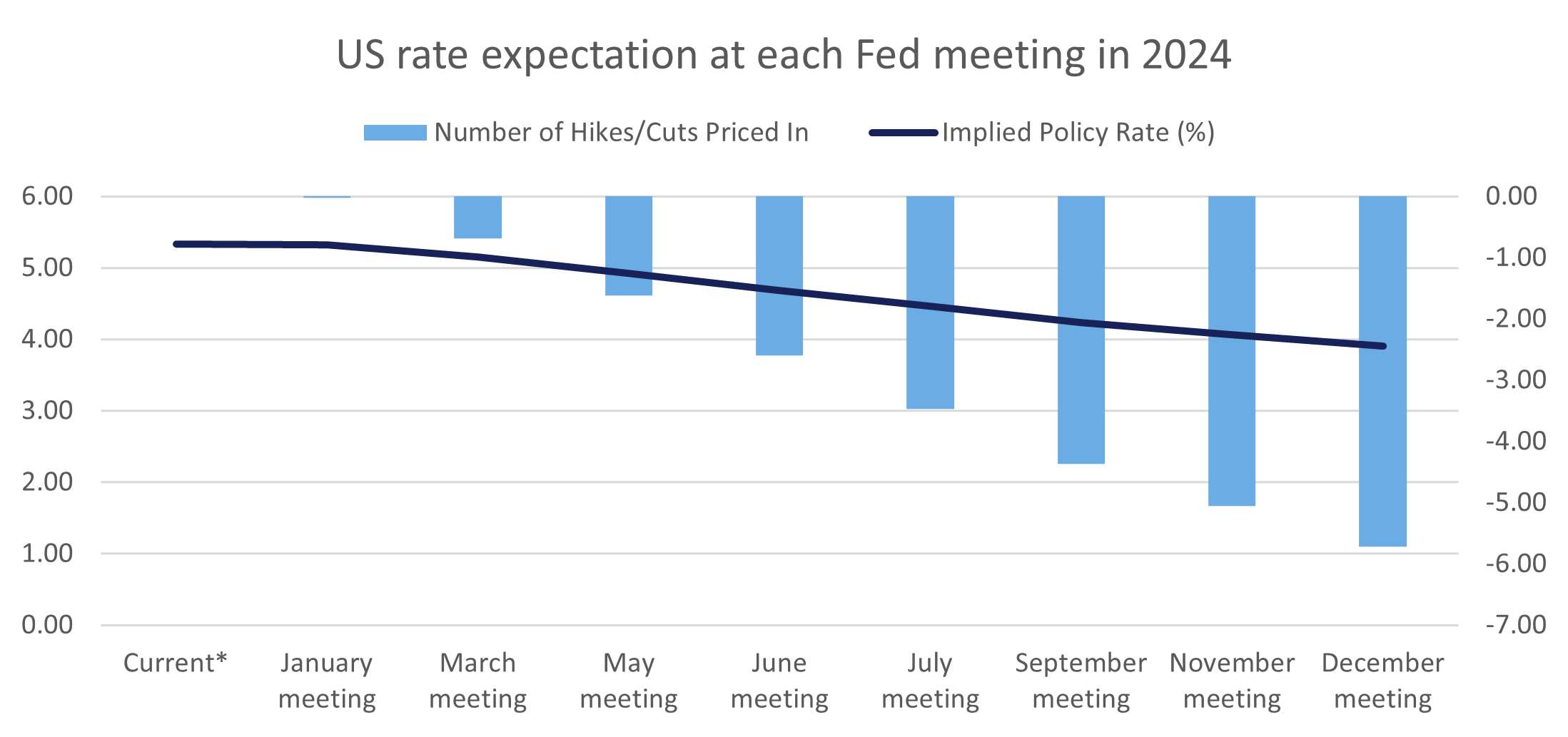

In late 2023, the Fed brought cuts into sharper focus, indicating in its most recent meeting that rate cuts will be forthcoming in 2024. Upon closer examination of the Fed’s language, the real consideration is the timing of these cuts and when the first cut will take place. Markets now expect the first cut to occur in the March meeting and are pricing in six 0.25% rate cuts in total in 2024. This is in sharp contrast to the Fed, which expects three cuts.

It appears the Fed is now closely watching real policy rates - which strip out inflation - to guide its future decisions. Headline inflation stands at 3.4%1, while interest rates are at 5.5%. This implies a real policy rate of 2.1%.

The latest Personal Consumption Expenditures (PCE) data, which is the Fed’s preferred inflation indicator, stands at 2.6%, down from prior months. With the rate of inflation likely to moderate over the coming months, this means that real rates will rise, making Fed policy more restrictive.

Why does this matter? If real policy rates are higher than the level of real economic growth, as expressed by GDP, this will act as an increasing drag on economic growth and increases the risk of a sharper slowdown. The Fed is now engaged in a delicate tightrope exercise, whereby it seeks to deliver a soft landing. In order to pull this off, it will have to cut rates as inflation moderates.

Markets have already aggressively priced in the rate cutting cycle, and the Fed understands that its language in December served to loosen policy as borrowers can now refinance at lower rates whilst equity valuations have risen. Perhaps markets have moved too aggressively in pricing in six 0.25% interest rate cuts. This had made Fed members wary that the first time they cut rates, markets may well price in further rate cuts.

Source: Bloomberg

*as at 11th January 2024

While policy is currently on autopilot at a lofty cruising altitude, they are doing the necessary checks to facilitate a soft landing. However, given the economic tailwinds and inflationary turbulence, they want to avoid a touch-and-go scenario. This means the necessary checks may take longer than expected.

As a result, the hurdle rate towards the first rate cut is high and is why the first cut is always the deepest.

[1] Bureau of Labor Statistics

This communication is provided for information purposes only. The information presented herein provides a general update on market conditions and is not intended and should not be construed as an offer, invitation, solicitation or recommendation to buy or sell any specific investment or participate in any investment (or other) strategy. The subject of the communication is not a regulated investment. Past performance is not an indication of future performance and the value of investments and the income derived from them may fluctuate and you may not receive back the amount you originally invest. Although this document has been prepared on the basis of information we believe to be reliable, LGT Wealth Management UK LLP gives no representation or warranty in relation to the accuracy or completeness of the information presented herein. The information presented herein does not provide sufficient information on which to make an informed investment decision. No liability is accepted whatsoever by LGT Wealth Management UK LLP, employees and associated companies for any direct or consequential loss arising from this document.

LGT Wealth Management UK LLP is authorised and regulated by the Financial Conduct Authority in the United Kingdom.