在此处更改您的语言和 LGT 位置。

私人客戶的數碼平台

登錄 LGT SmartBanking

金融中介機構的數碼平台

登錄 LGT SmartBanking Pro

解答常見問題 (FAQ)

LGT SmartBanking 幫助

解答常見問題 (FAQ)

LGT SmartBanking Pro 幫助

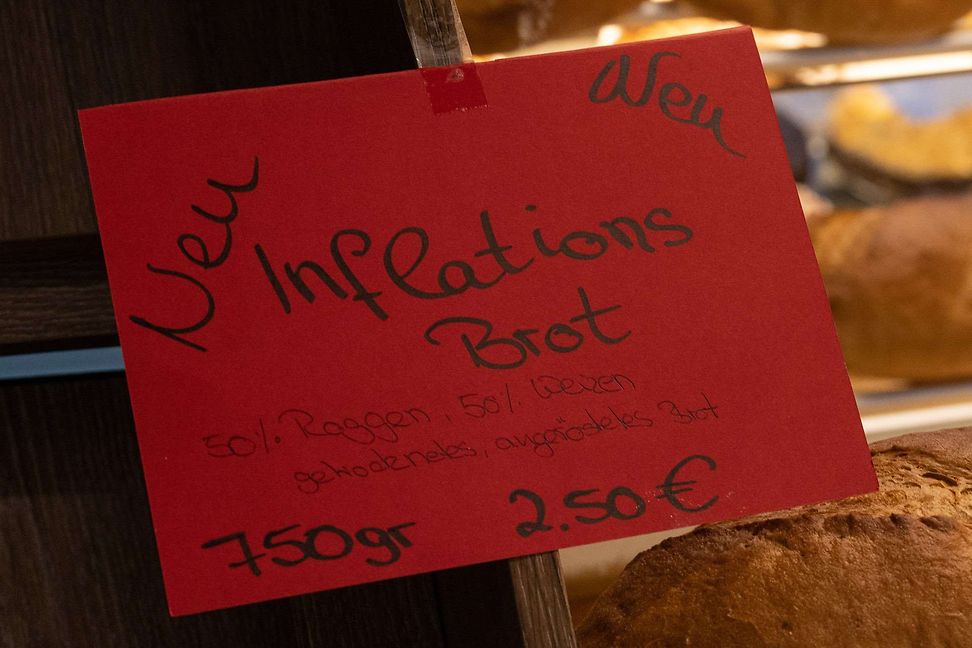

Inflation looks unlikely to disappear soon – but does it always spell doom and gloom for investors?

Most of us have watched higher prices wreak havoc on our outgoings and the value of our savings last year. Fortunately, there are a few simple stock strategies that can help you get through turbulent inflationary times and potentially even benefit from higher prices.

Inflation in the US may have peaked this summer, but although it’s falling, it’s still far off the 2 percent target set by the major central banks around the world.

In the euro area, inflation remains above 9 percent. Despite the countermeasures taken, most economists are hesitant to declare victory in the battle against inflation too early, as there are many reasons price increases could stay above targets for some time:

Inflation and rising costs generally pose a threat to companies’ profit margins. How can investors protect themselves against the impact of dwindling corporate margins? One way is by concentrating on companies that are well-positioned to deal with rising costs. Here are some intelligent strategies to help protect your stock portfolio.

As we saw above, when prices rise, employees demand higher wages. The labor market has proven more resilient than expected in places like the US, which may strengthen workers’ bargaining power. For many companies, wages are a major cost driver, and this affects profitability.

So investors should avoid companies battling with rising wages by steering clear of labor-intensive sectors (e.g. hospitality, restaurants, retail sales, and logistics).

LGT’s experts analyze global economic and market trends on an ongoing basis. Our research publications on international financial markets, sectors and companies help you make informed investment decisions.

Whether a company can pass on higher costs to its customers depends largely on the goods and services it sells. Companies that focus on affluent consumers can generally cover rising costs by charging higher prices. These companies have what’s known as strong pricing power, which means higher prices hardly affect demand for their products.

For wealthy customers, essential expenses for everyday goods, which have become much more expensive, account for only a small share of their disposable income. Increases in the cost of living have little impact on their ability to consume. This is particularly evident in the luxury goods industry. Thanks to the exclusivity of the products and the strength of iconic brands, price rises are easier to introduce. The reopening of China – the most important market for luxury goods - could provide additional support for this industry.

Given the advantage of strong pricing power in the luxury goods industry, this would be a good area to invest in.

The banking business is labor intensive, and not well-known for superior cost management or pricing power. Historically, investors have avoided this sector in a recessionary environment. However, the monetary policy measures put in place to combat inflation via higher interest rates are currently favorable for the banking sector.

This is because banks' business models generally rely on the difference between the interest they generate via their interest-bearing assets (loans, mortgages, securities, etc.) and the interest they pay out to customers for their deposits. After years of zero or negative interest, rates are rising, giving banks more room to make money on the difference between interest-bearing assets and liabilities.

Banks that are particularly interest-rate sensitive are expected to achieve higher earnings through this, allowing them to offset their higher wage costs and higher provisions set aside in case of default. Investing here could offer appealing protection against inflation.

One of the key drivers of inflation is energy prices. For most companies, higher energy prices manifest as higher costs for fuel, heating, and energy-intensive industrial processes.

However, for companies selling energy (including sustainable energy), these higher prices translate into higher revenue. Energy prices took off in 2022, particularly in Europe, where supply was constrained due to the war in Ukraine. While increased energy costs hit consumers and companies alike, energy companies did very well, with the performance of the energy sector outpacing most other investments.

This can be a good sector to invest in, although it’s worth noting that energy prices can be extremely volatile, and investors should be willing to accept large asset price swings.

Holding on to large amounts of cash can be very costly during periods of high inflation. But with the right equity strategy, you can reduce the risk of inflation on your portfolio, and potentially even benefit from rising prices.