- Home

-

Private banking

-

LGT career

With markets in many countries, trading in carbon credits is an essential feature of the journey to global net-zero emissions. An overview.

You may be aware of the phrase, "if you can’t measure it, you can’t improve it". As the world has become more focused on the effects of climate change, companies have become more aware of their carbon emissions and the impact of these emissions. And for many years, climate activists strove to get companies to measure and improve their carbon footprint.

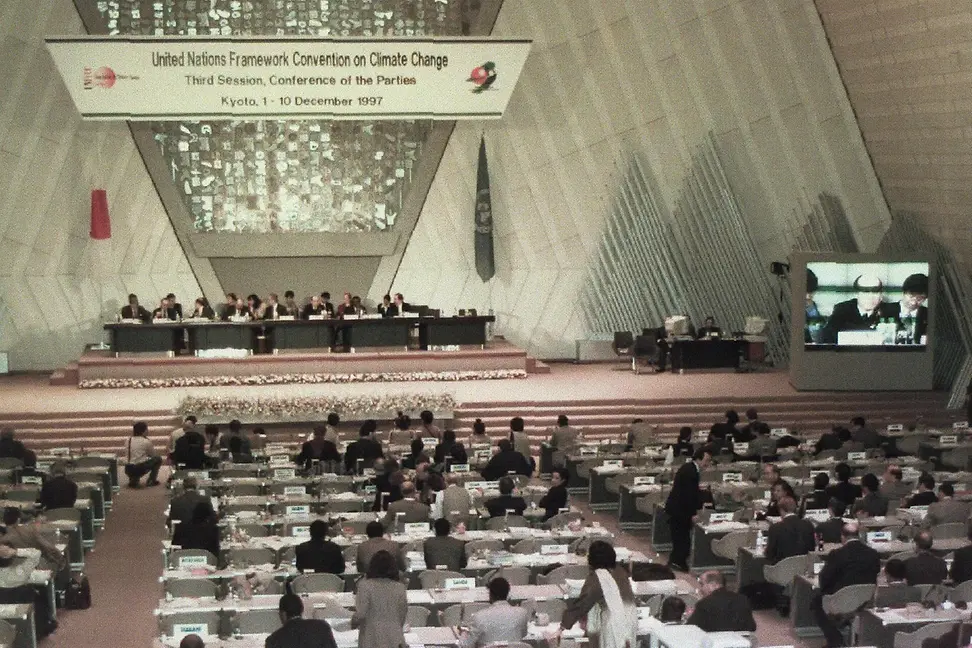

This activity snowballed with the adoption by many countries of the Kyoto Protocol in 1997, which included the first formal carbon emissions trading system. This UN-sponsored programme enabled countries to develop formal targets for limiting or reducing greenhouse gas emissions, of which carbon is the principal component. Unused emission units, i.e., those below the country’s target, could then be tracked and sold to other countries.

From this framework, many countries developed formal, internal, sometimes called "compliance" or "regulated markets" that complemented some already existing voluntary efforts. Companies in these countries were required to measure their emissions output. Any excess or unused emissions could then be sold to other companies that needed more capacity in these new mandatory markets. Hence a new commodity market was borne.

However, because some of the world’s largest countries (and largest emitters of greenhouse gases) - the US and China - did not sign the Kyoto Protocol, carbon trading on the international level between countries didn’t take off immediately. Momentum increased substantially in 2015 when the Paris Climate Agreement was signed by 174 countries including the US and China, with the US having withdrawn from it recently.

Mandatory carbon markets work on the basis of a system of carbon accounting where the units are emission allowances. Each emission allowance is equal to one metric ton of carbon dioxide emitted. Most regulated carbon markets operate a cap-and-trade programme whereby an overall cap on emissions is established by a single country or group of countries. Participants (usually countries or companies) then receive their individual emission allowance assignment, which forms the basis for trading - buying or selling excess allowances.

nd-Trade"-Programm, bei dem ein einzelnes Land oder eine Gruppe von Ländern eine Gesamtobergrenze für Emissionen festlegt.

The voluntary carbon market is, as the name suggests, unregulated. They often focus on carbon offsets, which are often created around a specific carbon reduction project. This could be a reforestation project or an investment in a new renewable energy technology. As the phrase suggests, carbon offsets are designed to compensate for the emission of carbon dioxide often as part of a larger commitment to reducing environmental impact.

There are about 30 compliance carbon markets around the world and one voluntary market. Today about USD 60 billion of carbon credits, including emission allowances and offsets,) is traded every month; this is up from just USD 10 billion five years ago. Some observers suggest that this could rise dramatically in the next ten years, outstripping even crude oil as the most heavily traded commodity worldwide.

Participants in these markets have a range of reasons for trading emission allowances or offsets. A company may have a specific need to purchase a carbon credit to stay under their assigned carbon limits within a country. Or they may be seeking to reduce the firm’s overall carbon usage as it seeks to reach a decarbonisation target. Finally, as carbon markets have become larger, more liquid, investors have joined the fray seeking the profit that can come from trading a commodity through futures and options, as well as physical carbon allowances.

The point of carbon trading is to reduce emissions globally over time by providing financial disincentives to those companies and countries that emit more than their fair share. In the European Union, emissions have dropped from 4.2 billion tonnes in 2004 to 3.1 billion tonnes in 2022. This is at least partly the result of concerted efforts at decarbonisation, of which carbon trading and the pricing of emissions is just one part. It’s also important to remember that Covid was still curtailiing many emitting activities in 2022, meaning that several more years of data may be necessary to fully understand the decarbonisation trend.

The largest carbon trading markets can be found in China and the EU, with smaller markets developing rapidly in South Korea, California and the United Kingdom. The EU Emissions Trading System, launched in 2005, has some of the widest coverage of any carbon market, with facilities in the energy, manufacturing and maritime sectors. The Chinese market, introduced in 2021, by contrast currently only covers power.

Carbon trading clearly has a place in ongoing efforts in climate change mitigation. But their development is not without controversy. The pricing methodology around emission allowances continues to be debated, even as more stringent regulations and standards are being developed. To ensure that a market functions well, all players need to be convinced that pricing is fair. While this is a complicated technical issue, some of the issues involve where the emissions are created – directly by the company concerned or in their supply chain, for instance. In addition, it can be difficult to distinguish between emissions that are just carbon or involve a range of greenhouse gases. Carbon offsets come in for the most vocal criticism, often because of the quality/integrity of the underlying projects .

Carbon trading is a critical element of the overall global effort to reduce carbon emissions, but with only 25 per cent of global emissions priced today, there is clearly plenty of room to increase its impact.