- Home

-

Private banking

-

LGT career

Investors have always watched monetary policy decisions with great interest. In the US, a committee of the Federal Reserve (Fed) plays a special role in this process.

The term "FOMC" is often referred to in financial journalism, especially when talking about how the US economy is developing. But what exactly do these four letters mean?

FOMC stands for Federal Open Market Committee. This is the body that determines the Federal Reserve's monetary and interest rate policy. Given the US's status as the world's largest economy, the monetary policy decisions of the Federal Reserve are of key importance for the global economy.

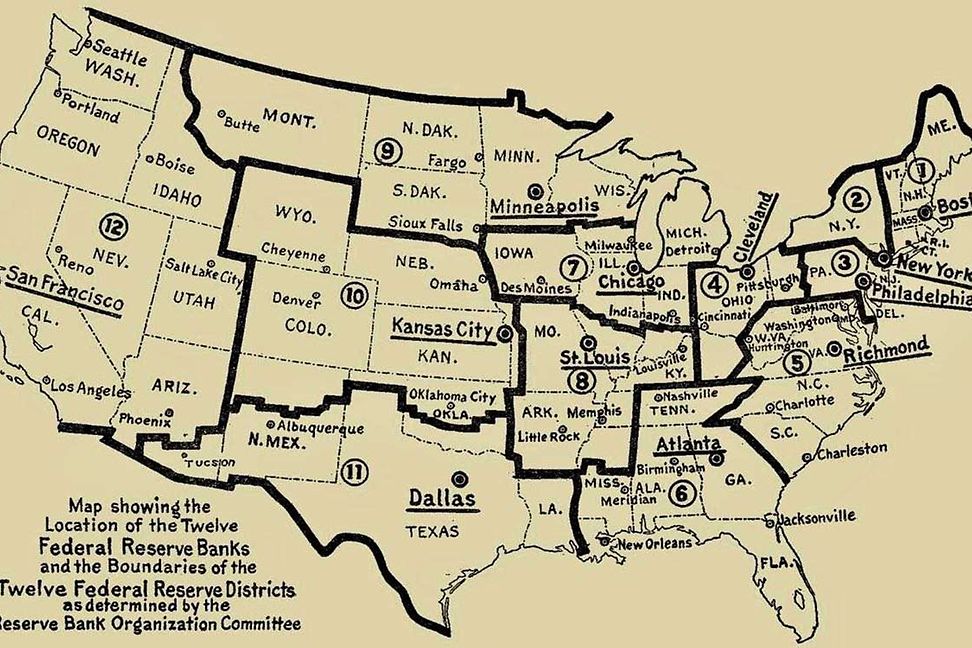

The Federal Reserve system is made up of twelve regional offices, known as Federal Reserve districts. These are New York, Boston, Philadelphia, Richmond, Cleveland, Chicago, St. Louis, Dallas, Atlanta, Kansas City, Minneapolis and San Francisco. The geographical distribution of the districts is designed to ensure that the interests of all regions of the United States are represented.

The FOMC has a total of twelve members. These include seven members of the Board of Governors and four regional Federal Reserve Bank presidents. The latter serve a one-year term on a rotating basis.

For historical reasons, the president of the Federal Reserve Bank of New York has a special role: he or she has a permanent seat on the FOMC. The FOMC is traditionally chaired by the Chair of the Board of Governors. Currently, this is Jerome Powell, who was appointed to the position on 5 February 2018 by the president at the time, Donald J. Trump. He was confirmed in this role for another four years by President Joe Biden on 22 November 2021. The Vice Chair is the President of the Federal Reserve Bank of New York, currently John C. Williams.

LGT’s experts are always busy analyzing global economic and market trends. Our research publications on the international financial markets, sectors and companies will help you make informed investment decisions.

The FOMC is required to fulfill its statutory mandate from Congress. According to this mandate, the FOMC is to ensure maximum employment, stable prices and moderate long-term interest rates. Because monetary policy determines the long-term rate of inflation, it is up to the FOMC to set a longer-term target for inflation.

The twelve FOMC members meet eight times a year for a regular meeting to discuss short-term monetary policy. In exceptional or crisis situations, the FOMC could meet more frequently. The regularly published economic report from the twelve district central banks - the so-called "Beige Book" - serves as an important basis for the committee's decisions.

Since FOMC meetings are not open to the public, the Fed as well as other central banks have recently tried to bring more transparency into their processes by improving communication. This is intended to reduce uncertainty and speculation in financial markets. One of these measures is the FOMC minutes, which are always published after a monetary policy decision.

As in any committee, different opinions and views are represented within the FOMC. This results in differences in economic assessments, inflation expectations and the direction of central bank policy. Observers often refer to the members of the FOMC as "hawks" and "doves": while the hawks support "hawkish", i.e. tighter monetary policy, the doves are seen as advocates of a "dovish" or looser monetary policy stance. The current Federal Reserve Chairman Jerome Powell is considered moderate in his stance.

As in any body, there are also different opinions and views in the FOMC. In this case, there are differences in economic assessments, inflation expectations and the direction of central bank policy. Observers often refer to the members of the FOMC as "hawks" and "doves": While the hawks stand for a "hawkish", i.e. tighter, monetary policy, the doves are seen as advocates of a "dovish" or loose monetary policy stance. The current Federal Reserve Chairman Powell, on the other hand, is considered moderate.

The FOMC has various tools for setting monetary policy. It can adjust the federal funds rate or change banks' reserve requirements. This enables the Federal Reserve to work effectively to increase or decrease interest rate levels or the money supply. By means of so-called "open market operations", government securities (Treasuries) are bought or sold. This either reduces or expands the money supply and impacts the liquidity available in the banking system.

The Federal Reserve is probably the most powerful institution in the financial world. Monetary policy decisions in the US - and especially those of the FOMC - can have global implications due to the importance and size of the US economy. They set the trend for capital markets, and sometimes also for other central banks, time and time again.

Header Visual © Liu Jie Xinhua / eyevine / laif.